As we at Victure Industrial Co. have expanded our business, we have reviewed opportunities with many new potential customers. In this process, we have encountered a large number of small businesses who have great product concepts, and great marketing plans, but insufficient knowledge of how to create and manage the supply chains that they need to cost effectively produce their products and support their customer requirements. Many of these small businesses also lack the financing required to scale-up production of their product(s) from the “prototype” and/or low-volume “product introduction” phases into the “mass production” phase.

Based on our observations, we saw an opportunity to provide a new service offering that would help these small businesses to establish appropriate, reliable, and cost-effective supply chains by combining our skills in supply chain management with our access to trade financing through banks and other institutions where we have well established relationships.

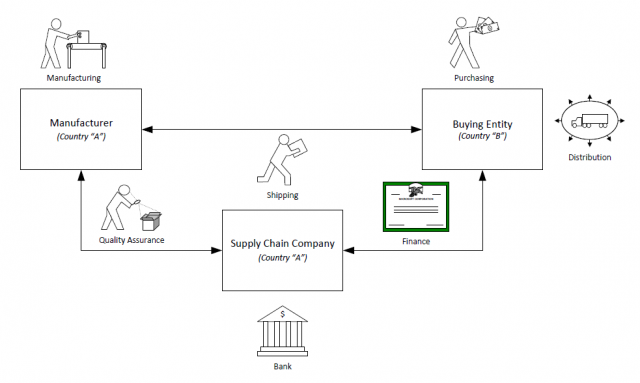

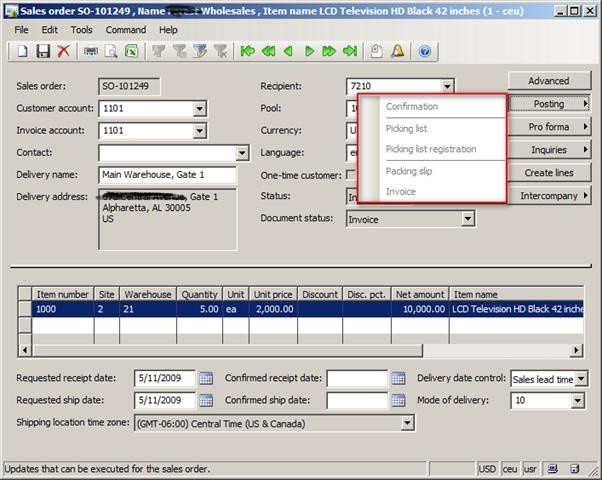

The graphic and the table below provide a high-level view of how our Supply Chain Financing Model functions:

Contractual Relationships:

Buying Entity and Manufacturer

Buying Entity and Supply Chain Company

Supply Chain Company and Manufacture

| RESPONSIBLE PARTY | |||

| HIGH LEVEL ACTIVITY | Buying Entity | Supply Chain Company | Manufacturer |

| Identification / Requirements Definition for products to be manufactured | Primary | ||

| Sales / Marketing / End Customer Service and Support | Primary | ||

| Sourcing / Identification of Manufacturer to provide required products | Primary | Support | |

| Qualification / Verification of Manufacturer to provide required products (including detailed site visit and QMS review) | Primary | ||

| On-going Quality Assurance & Performance Management of Manufacturer (including outbound inspection as needed) | Primary | ||

| Setup / Secure Financing to pay for manufacturing and logistics costs for products to be manufactured for Buying Entity | Primary | ||

| Transmission of Order Requirements from Buying Entity to Manufacturer | Primary | Support | |

| Receipt of Order Requirements from Buying Entity to Manufacturer | Support | Primary | |

| Production of Order Requirements from Buying Entity to Manufacturer | Primary | ||

| Payment to Manufacturer for products manufactured for Buying Entity | Primary | ||

| Payment to Supply Chain Company for products manufactured for Buying Entity | Primary | ||

| Shipping / Export Arrangements and payments (including all Export Duties, Taxes, & Fees) for products made by Manufacturer and destined for Buying Entity | Primary | ||

| Import Arrangements and payments (including all Import Duties, Taxes, Fees) for products made by Manufacturer and destined for Buying Entity | Primary | Support | |

| Shipping / Warehousing / Distribution Arrangements and payments for products made by Manufacturer from point of importation to end customer location(s). | Primary | ||

| Periodic (e.g. monthly) reviews of Buying Entity’s business results and on-going supply chain financing requirements. | Support | Primary | |

As of this writing, we have implemented this Supply Chain Financing Model with a handful of different customers, and the results so far have been very good for those customers as well as for Victure Industrial Co.

Given the success we have had thus far, we decided to publicize this Supply Chain Financing Model to a broader audience and to invite anyone who would like to learn more about how this Model can help them to grow their business to contact us as noted on our web site: http://victuregroup.com/contact/.

While you are visiting our web site, feel free to explore all of our other service offerings. You will find that we have a lot to offer.

Join the largest China Sourcing LinkedIn group at https://www.linkedin.com/groups/4462099/

October 13, 2023

Ultimate Guide for Canton Fair TourLow and High Production

July 08, 2021

Low and High ProductionLow and High Production

June 30, 2021

CAD, BOM, DFM & IPLow and High Production

June 17, 2021

Order Volume ConsiderationsLow and High Production

June 09, 2021

Product Requirement DocumentLow and High Production